Paytm: A Sinking Ship of Obsolete Apps or a Financial Super-App?

This week we will discuss Paytm, its numerous business ventures, understand its business model, its finances and finally discuss its vision and scope of profitability.

Paytm: A Sinking Ship of Obsolete Apps or a Financial Super-App? | Product Analytica | Virtual Stock Market

24/11/21

Thank you to the people who have joined!❤️ If you are new to Product Analytica, please subscribe and help us spread this crucial analysis of convoluted products.

If you are new, here’s what Product Analytica is all about.

Every week we pick a listed company, spend time studying its core strengths and threats, look into its recent strategies and analyze its position in the stock market. Recommend a few bets that might shape the stock market in the given sector. The outcome of the newsletter is a deep understanding of the company and the sector, which in turn would help you research and invest soon.

Let’s get started 🚀

Paytm: A Sinking Ship of Obsolete Apps or a Financial Super-App?

This week we will discuss Paytm, its numerous business ventures, understand its business model, its finances and finally discuss its vision and scope of profitability.

About Paytm:

(P.S: There is a lot of buzz about Paytm and I am sure that you must have read a lot about it, so this section might just be a refresher for most of you)

Paytm is known for its security and customer protection and became super popular after Demonetization.

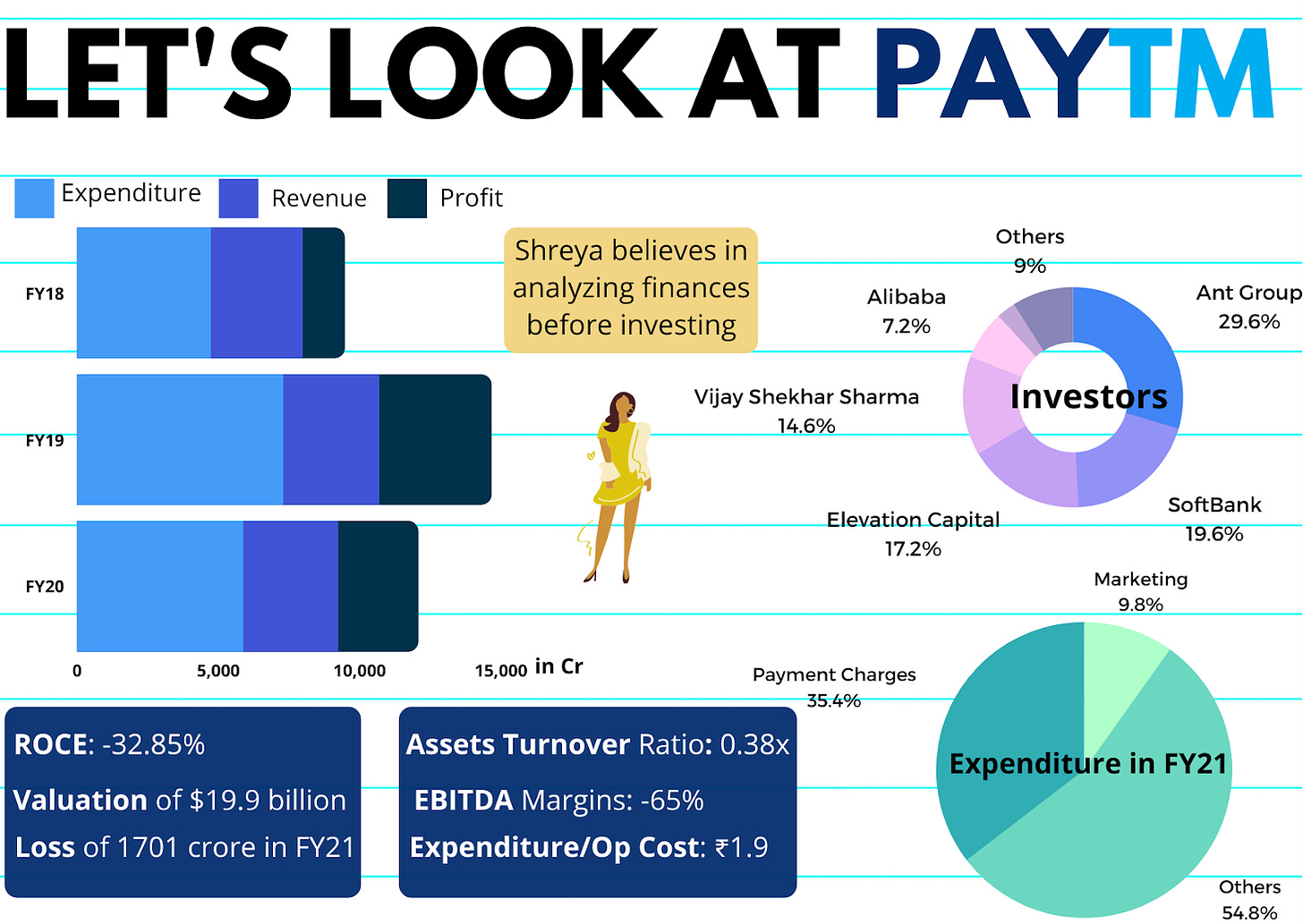

Paytm’s IPO raised over 18,300 Crores ($2.5 billion)

Its valuation was over $19 Billion

Its investors include Ant Group, SoftBank, Alibaba, and a few more.

The company intends to use fresh funds from the IPO to grow its customer base, fund acquisitions, and for general corporate purposes. (But what’s the strategy for profitability?)

It has 333 million consumers and 21 million merchants (That’s a huge market!!)

It has used a lot of resources to acquire merchants, but numbers say that 9% decline in merchant growth in FY21 and FY20.

Its net loss shrank an impressive 42% in FY21.

But Operating revenue contracted over 10% (majorly due to Covid19).

Interestingly, payments to merchants went up by 33%.

A report by Bernstein analysis said it expects Paytm's revenue base to double by FY23 to USD 1 billion, with non-payments revenue contributing 33 percent, led by credit tech (we will talk about this soon).

But seriously, how did Paytm get such a huge customer base?! And why hasn’t it been Profitable yet?

Paytm (being backed by the biggest VCs) has been throwing money at a problem and providing flat discounts, cashback, offers to lead to aggressive customer acquisition but also leads to burning of money for Paytm.

Well, it has been successful in attracting customers but its problem is an all-in-one app, centered on payments while offering everything from insurance to banking services to ticket sales, this looks less unique than it once did.

Paytm once had an advantage in the Indian Sector, because of its trove of licenses (which helped them set up Paytm Wallet), but many other companies are already in the queue to get these regulations (making Paytm less attractive).

Paytm Wallets were once very powerful and major money-making sources in China for Paytm, but now with the rapid commoditization of India’s payment sector, built on top of an open-access digital infrastructure (UPI), wallets are becoming obsolete.

Even KYC and 2-factor authentication were made compulsory for wallets in 2017, leading to inconvenience to Paytm users.

This has resulted in UPI services overtaking wallet-based services and thus Paytm being a distant third behind Google Pay (41%) and homegrown rival PhonePe (35%).

There have been claims that Paytm has only 60 million users who are monthly active users, which proves that over 50% of its annual transaction users (150 million) don't regularly use Paytm.

Business Model of Paytm:

This diagram helps us quickly understand how vast Paytm's business is and how many competitors it has (P.S: It’s just not Google Pay and PhonePe).

Paytm makes most of its revenue from commissions and as a cross aggregator, let’s look into some ways it actually does it:

Paytm Wallet (B2C):

The money you deposit in Paytm Wallet will be transferred to another bank by Paytm (into an escrow account) and the interest rate generated is pure profit.

Transferring money back to banks from wallets generates commissions.

Crypto giants like CoinSwitch Kuber are aggressively entering the payment space.

Commissions (B2C):

It takes a small cut from vendors for each transaction that is done via Paytm. For example, for a recharge of ₹100 you make for availing a Jio recharge, Paytm makes ₹2-3 from Jio. With many vendors in the business, Paytm can negotiate well and get these high commission rates.

Paytm implemented an Offline-to-Online(O2O) concept where payment can be done in any offline shop (registered with Paytm) with QR codes(Payment Solutions).

With Paytm Insider, Paytm acts like an aggregator for shows, events, and even trips.

Because of this, they have ensured a steady flow of revenue.

Paytm Mall(B2B):

With over 21 million vendors on its platform, Paytm mall facilitates these vendors to sell and deliver their products like an e-commerce platform. Behind every sale, Paytm makes money.

Advertisements and brand promotions are huge sources of revenue.

Paytm has been experimenting with bulk ordering (Paytm Bang) for customers, with larger bulk comes larger profits (proper referral program and gamification could lead to a great business model). This hasn’t been a very successful initiative till now, let’s see how Paytm moves forward with it.

Paytm First:

Subscription and Referral program(Competition to Amazon Prime and Flipkart Plus). It provides cashback, advantages on Paytm Mall, a credit card.

They also launched a gaming vertical (great move for user acquisition and retention), First Games which has fantasy sports, casual games, and esports.

With 50 million users, it targets a $1.6 billion gaming market in India.

Business Software (B2B):

Paytm is facilitating its offline vendors by providing various business software, CRM, cloud services, billing facilities, etc. This is a highly profitable business model with fewer complications.

Digital Gold (B2C):

Paytm provides a service to buy, sell, store digital gold. It even provides a service to deliver this gold.

This is made possible by its partnership with MMTC-PAMP.

Paytm Money: Cross-Selling(B2B)

Stocks, mutual funds, insurance can be bought from Paytm.

No commission attracted customers.

But of the 5600-odd reviews for its Android app )from the 500,000+ users who have downloaded it), the average rating is just 2.9/5 stars. Some have even criticized the mutual fund selections of Paytm.

Paytm Insurtech(Paytm Insurance Broking) products across auto, life and health insurance, and policy management and claim services. After acquiring Raheja QBE, Paytm can now design, price, and sell its insurance (just like acko) along with cross-selling other insurances.

Insurance penetration in India is just 3.8%. Policy Bazaar controls over 90% of the online insurance space, but there is room for expansion in India. I am very bullish in this sector.

Paytm Payments Bank (Lending (B2B+ B2C):

Paytm Postpaid (Buy Today, Pay Later), has disbursed three million loans and postpaid products to date.

Users can get an instant personal loan as small as Rs 250 to Rs 60,000. This is made possible because of NBFCs and Banks it has partnered up with.

Paytm disbursed 1.4 million loans, 53 times higher year-on-year, during January-March 2021

Paytm Payments Bank with a total of 65 million accounts and deposits worth Rs 5,800 crore.

India's market of digital lending grew from $9 Bn in 2012 to $150 Bn in 2020.

Small Finance Bank (SFB) license, Paytm will be able to get this in 2022: there are 9 SFBs currently..can issue credit cards, can offer small loans, Fixed Deposit and Recurring Deposit, demand deposits, can open offline banks.

There are only 9 SFBs and this might be the turning point for Paytm and might lead to high profits for Paytm considering their vast network of merchants.

Obtaining a small finance bank license could be difficult in our view given that Chinese-controlled firms own more than a 30 percent stake in Paytm Sources. And Paytm’s board with 75% of its members is based out of India.

Finances Of Paytm:

Doesn’t seem very positive right now!!

Future Vision:

Research firm Bernstein calculates Paytm has higher revenue for each of its monthly active users than competitors. Next year it will be eligible to apply for a banking license that allows it to offer small-ticket loans off its balance sheet.

If they manage to get an SFB license then they will be able to churn profits from this.

Even growth in insurance sectors will lead to positive cash flow.

All apps combined lead to a super app where they can bundle programs together, e.g. insurance with ticket booking, bundled with their eCommerce business.

If these factors are worked properly then it might be able to turn profitable in 2 years.

Thank You,

(PS: This was a really lengthy article, if you have made it this far then thanks a lot!!)

This was an amateur attempt to condense Paytm’s position in India. We are still experimenting with content type and would love to hear your feedback, so please fill this feedback form or drop us a dm on our Instagram page!